Introduction

The European cosmetics and personal care emerged as the largest industry. This sector not only plays a significant role in the economy, but it also stands as a crucial sector for research and development, employing around 30,000 scientists. Nowadays, the cosmetics industry faces several challenges in the development of innovative products, with the main goal of meeting the different needs of consumers in the ever-changing world of beauty. With increasing competition and technological advancements, finding new innovation strategies becomes crucial for success and sustainability. This dynamic industry demands continuous reinvention of products and strategies. Innovation in this sector encompasses a broad spectrum from the extraction of natural compounds to marketing strategy and product formulation. Innovation in this industry is not a short-term endeavor, given that the journey from development to market launch for a new product often spans over five years. Additionally, it’s a dynamic process – each year sees about 25% of cosmetic products undergoing enhancements or being entirely new creations. The volume of patent activity serves as a meaningful measure of this innovation, with a notable percentage of patents granted in the European Union pertaining to cosmetics, which hit a high of 10% in 2009. To innovate better, it is important to have a deep understanding of changing consumer trends, advances in science and technology, and a commitment to ethical and sustainable practices.

In the following articles, we will explore the different ways in which innovation can be fostered within the cosmetics industry, including embracing cutting-edge research, leveraging digital transformation, implementing sustainable practices, and promoting inclusive and diverse product development.

A series of five articles will be published, each showcasing an innovation strategy: Sustainability, Natural Ingredients, Digitalization, Science and Consumers focus. In these articles, you will find a review of the context driving cosmetic companies to engage with this innovation lever, followed by a comprehensive list of companies actively involved in this area, exemplifying how various players are addressing these topics. We hope these articles will be valuable in effectively contributing to your scientific monitoring.

STRATEGY #1: SUSTAINABILITY

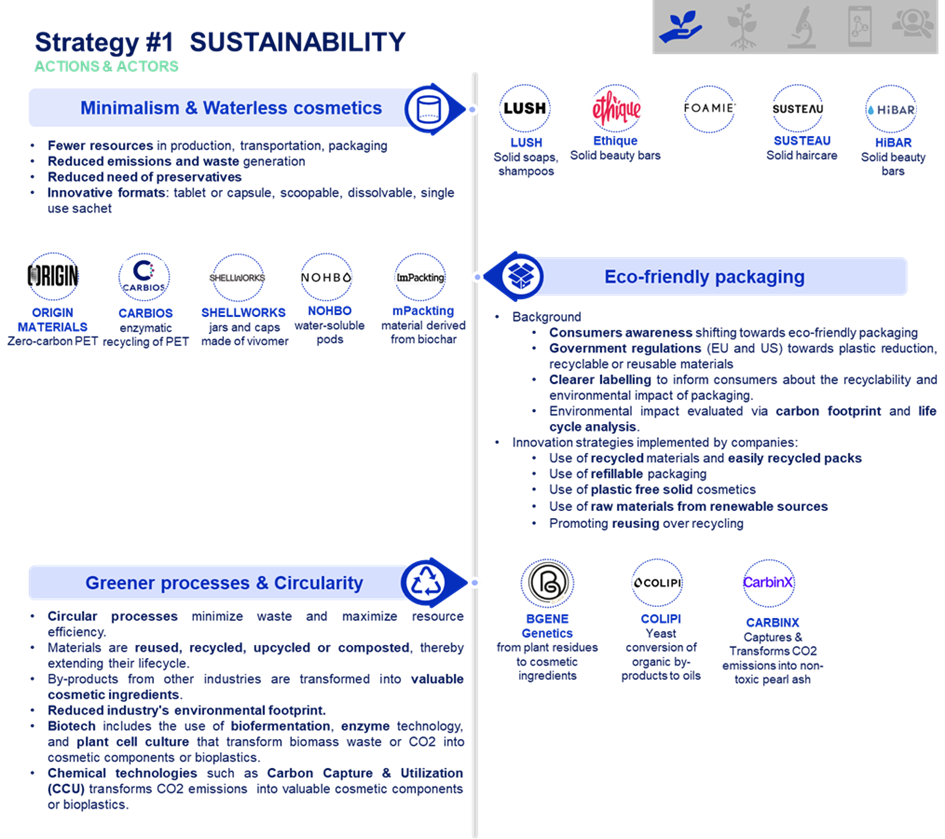

In this uncertain environmental context accompanied by individuals’ growing ecological awareness, cosmetics companies are moving forward greener processes and sustainable cosmetics to reduce environmental pollution and greenhouse gas emissions. More and more consumers, particularly Millennials and Gen Z, are becoming aware of the negative impact of products on the environment, giving rise to the development of sustainable cosmetics. Sustainability strategies are now indispensable in the cosmetics industry. A wave of cosmetics startups and corporates are applying the following actions to enhance sustainability:

- the use of minimalist formula and waterless cosmetics

- the use of eco-friendly packaging

- the use of greener processes & circularity

Minimalism and waterless cosmetics

Minimalist formulations such as waterless cosmetics use fewer resources in production as well as in transportation and packaging. Therefore, removing water content from products results in reduced emissions and waste generation, making them more environmentally friendly. In addition, formula with decreased water content are less prone to microbial contamination and thus reduces the need for additives such as emulsifiers and preservatives. Considering that a bottle of shampoo, shower gel or hand soap consist mainly of water, many companies have introduced to the market new formula with highly concentrated active ingredients. To facilitate consumer use & carrying, waterless cosmetics require innovative strategies such as tablet or capsule formats, scoopable products, dissolvable films, single use sachet.

Actors

According to an article from 360 Research Reports posted in November 2023, the largest manufacturers of waterless cosmetics are Unilever, L’Oreal, Procter & Gamble, Pinch of Colour, Clensta, Loli, Kao, Azafran Innovacion. Below is the list of players using waterless cosmetics as the main innovative strategy.

- Pinch of colour, a US beauty brand defining itself as the Waterless beauty company. It is the first ever waterless beauty brand in the U.S that delivers beauty with a cause: to conserve water.

- Lush Cosmetics, a British cosmetics retailer known for their eco-friendly and ethical approach, Lush offers a range of waterless products like shampoo bars, conditioners, and solid body washes.

- Ethique, a New Zealand-based company specializes in solid beauty bars for hair, face, and body care, with a strong commitment to sustainable and plastic-free packaging.

- Beauty Kubes, a UK-

based brand offering innovative shampoo and body wash cubes that are activated with water. - Dew Mighty, a Californian brand producing concentrated serum bars for skincare, emphasizing zero waste and sustainability.

- Foamie, a German company known for their range of solid haircare and body care products, Foamie offers an array of waterless beauty options.

- Seed Phytonutrients: a 100% natural US startup that sprouted within L’Oréal, they offer products with minimal water content and focus on sustainable packaging and natural ingredients.

- Susteau, a US brand known for their water-activated haircare powders.

- HIBAR a US brand offering plastic free hair, body, and face care products.

- TECHNATURE, a company localized in Brittany, France, that commercializes an innovative cleansing care on the market comes in the form of lyophilized solid pearls. This ultra-light form allows for easy transportation and just the right amount of product needed: two pearls are sufficient for one application.

- NUWEN from Roullier group based in Saint-Malo, France, develops tablets that dissolve in water create a hygiene product, such as a body shower gel or a hand wash gel. Developed using Tab&Care technology, the tablet is the result of compressing powder made of natural ingredients and delivers the right dose of the product.

Ecofriendly packaging

The cosmetics industry involves a substantial number of packaged products used daily by billions of people worldwide. These packaging are mostly plastic based which are not recycled and accumulate in the environment. Sustainability is a hot topic for the packaging industry as well as for consumers, especially millennials and Gen Zers, which are looking more and more at eco-friendly alternatives. This shift toward sustainable packaging is accelerated by government regulation in the EU and some US states including California, New York, and Maine.

Many countries are implementing regulations to reduce the use of single-use plastics. Bans on specific types of plastic packaging (like microbeads in cosmetics) are becoming more common. Regulations are increasingly requiring packaging to be recyclable or made from recycled materials. For instance, the EU has set ambitious targets for packaging recyclability. Extended Producer Responsibility (EPR) policies, which make producers responsible for the end-of-life impact of their packaging, are being implemented in more regions. This often includes the requirement for producers to contribute to the costs of recycling and waste management. New regulations often include requirements for clearer labelling to inform consumers about the recyclability and environmental impact of packaging. Some regions are promoting the development and use of biodegradable and compostable packaging materials. Increasingly, regulations are considering the overall environmental impact of packaging, evaluated by its carbon footprint and life cycle analysis.

In a crowded market, sustainable packaging is a key area where cosmetics companies can innovate and communicate their commitment to the environmental cause. In response to consumer demands for improved packaging sustainability, companies are looking to easily recycled & reusable materials, refillable packaging and plastic free solid cosmetics.

Actors

- Typology, a Paris based skincare brand using durable packaging such as glass bottles, aluminum and recycled packaging and to 100% recycled plastic bottles.

- The Body Shop, a London retail company that launched its refill stations globally in March 2021, allowing consumers to refill shower gels, hand soaps, shampoos, and conditioners in stores. Sephora has refill stations for certain perfumes.

- MAC Cosmetics, a US brand, and Lush, a British brand allow consumers to return empty product containers to be recycled for free items.

- Origin Materials, a Californian company which in partnership with LVMH and Revlon, develops zero-carbon PET packaging made from wood residue and old cardboard. The technology behind is a chemical conversion of C-6 cellulose into four isolated building-block chemicals, in one chemo-catalytic step with almost zero carbon loss.

- Carbios, a French biotech company based in Clermont-Ferrand, and L’Oréal winners of the “Pioneer Awards” for the creation of the world’s first cosmetic bottle made from enzymatic recycling. This method uses enzymes to break down the long PET polymers into its basic building blocks monomers, primarily terephthalic acid (TPA) and mono ethylene glycol (MEG), which can then be used to create new PET products. The pilot edition of « Waterlover » from Biotherm (L’Oréal) in 2021 is based on Carbios recycled PET.

- Shellworks, a London-based company featuring home compostable multi-purpose jars and caps made of vivomer, made from fermentation with microbes readily available in marine and soil environments that create a polymer called polyhydroxyalkanoate in their cells.

- Nohbo, a Florida based company specializing in personal care offering water-soluble pods for shampoo, conditioner, body wash.

- Notpla, a UK company developing sunscreen pipettes, bath oil sachets, toothpaste pearls, skincare pearls as well as rigid packaging made from seaweed and plants.

- MAMEHA, a Japanese startup, presents minimalist 3D printed packaging. The product is composed of only 4 components, using only 2 technologies to manufacture a glass and polymer structure. To create the container, the company worked with Carbon, using its Digital Light Synthesis technology. In some ways, DLS works similar to Stereolithography (SLA) 3D printing process, in that it uses a light source to cure a liquid photopolymer. Its main advantage is the speed of the manufacturing process, which, unlike SLA, is much faster.

- mPackting brand from Minelli group based in Bergamo in Italy, produces wooden components and packaging. mBlack™ an exclusive material derived from biochar and recognized as a carbon sink, effectively absorbs CO2 from the atmosphere in the long term. Combined with a biodegradable biopolymer, mBlack presents itself as a sustainable replacement for plastics, with the same functionality and versatility as standard plastics and can be molded, decorated and customized.

- PaperFoam, based in the Netherlands, provides biobased packing solutions. PaperFoam® is used as primary packaging for Half Magic beauty brand eyeshadow compact. It is a sturdy, lightweight, and biodegradable material created with industrial potato starch and molded cellulose. This material is both home compostable and curbside recyclable with paper goods.

Green processes & circularity

Heavy pollution, the release of non-biodegradable substances and the use of fossil polymers in cosmetics are detrimental to the environment. Driven by conscious consumers, the cosmetics market is turning to greener processes. Circular processes in the cosmetic industry are pivotal as a sustainability strategy, aiming to minimize waste and maximize resource efficiency. This approach fundamentally changes the traditional linear model of “take, make, dispose” into a regenerative loop where materials are reused, recycled, or composted, thereby extending their lifecycle. One key aspect of circularity in cosmetics is the use of recycled or upcycled ingredients, where by-products from other industries (like food or agriculture) are transformed into valuable cosmetic ingredients. Consumers are more inclined towards brands that demonstrate environmental responsibility, making circularity a strategic approach for both ecological and economic sustainability. In summary, circular processes are not just an environmental necessity but a strategic business approach for the cosmetic industry to thrive sustainably.

To markedly diminish the production of waste, more environmental-friendly processes are adopted. These include biotechnological and chemical technologies that transform biomass waste or CO2 into cosmetic components or bioplastics. This approach aligns with the principles of a circular economy, emphasizing sustainability and resource efficiency.

First Generation Feedstocks are derived from food crops like corn, sugarcane, and soybeans. The use of these feedstocks for industrial purposes, including packaging, has been criticized due to their direct competition with food resources, which can lead to higher food prices and potential shortages. Second Generation Feedstocks are derived from non-food biomass. This includes agricultural residues, wood waste, and non-edible parts of plants. Using second-generation feedstocks for cosmetics packaging is more sustainable than first-generation ones as they do not compete with food supplies. They are often used to produce bioplastics and other eco-friendly packaging materials. Third Generation Feedstocks primarily involves algae and microorganisms. These feedstocks are gaining attention because they can be cultivated in environments that do not compete with agricultural land, such as in seawater or wastewater. Third-generation feedstocks can produce bioplastics and other materials with a smaller environmental footprint. They also have the potential for higher yield and efficiency in biomass production compared to the first and second generations. In the cosmetics industry, transitioning to second and third generation feedstocks for packaging is part of a broader effort to reduce environmental impact. This shift includes exploring more sustainable packaging materials that reduce reliance on fossil fuels and minimize ecological footprints. As consumer awareness and demand for sustainable products grow, the use of these advanced feedstocks in packaging is likely to increase.

Carbon Capture Technology (CCT) refers to a set of methods and technologies designed to capture carbon dioxide (CO2) emissions produced from various industrial processes, particularly those associated with the burning of fossil fuels for energy. The goal of CCT is to reduce the amount of CO2 released into the atmosphere, thereby helping to mitigate the impacts of climate change by limiting greenhouse gas emissions. Once captured, CO2 can be either stored (sequestered) or utilized in various ways. The captured carbon can be transformed into various forms and used as an ingredient in cosmetic products. For example, CO2 can be converted into carbonates or other compounds used in skincare or makeup products. By using CO2 that would otherwise contribute to greenhouse gas emissions, cosmetic companies can reduce their carbon footprint. It’s a form of ‘upcycling’ carbon emissions.

Biotech processes in the cosmetics industry involve leveraging biological systems, organisms, or derivatives to develop or create cosmetic ingredients in an environmentally friendly manner. They offer a sustainable alternative to traditional chemical synthesis, reducing the industry’s environmental footprint. Secondly, biotech processes can produce highly effective and novel ingredients that meet the growing consumer demand for natural and eco-friendly cosmetics. This approach often includes the use of technological aspects in the context of manipulating biological systems, involving both microorganisms and plant cell cultures. For instance, biofermentation allows the production of active cosmetic ingredients through the cultivation of specific microorganisms under controlled conditions. This method can yield high-quality, pure ingredients, and is scalable and sustainable. Enzyme technology uses natural catalysts to create or modify ingredients, often enhancing their efficacy or reducing the need for harsh chemicals. Plant cell culture, another innovative method, involves growing plant cells in a lab to produce specific compounds. This allows for the consistent production of rare or seasonally limited natural ingredients and can also overcome challenges associated with traditional agricultural methods, such as the need for extensive land, resources, and susceptibility to environmental conditions. Advanced biotechnologies, like synthetic biology and fermentation, apply the CCT method using captured CO2 as a feedstock. Certain microorganisms or engineered bacteria can convert CO2 into valuable compounds like alcohols, acids, or even polymers, which can be used in cosmetic formulations. Apart from ingredients, captured carbon can also be used in developing sustainable packaging materials for cosmetics. This approach can significantly reduce reliance on fossil fuel-based plastics.

Actors

- BGene Genetics, a biotech company localized in Grenoble, France, developing bioprocesses with eco-catalysts® using waste from the forest industry, with the idea in mind that their bacterial chassis is capable of “eating” the sugars from this wood waste to make molecules of interest such as ceramides and phenylpropanoids. BGene is part of a true circular economy, from plant residues to cosmetic ingredients.

- Colipi a German biotech company using bioengineering expertise to convert industrial organic byproducts into oils facilitated by naturally occurring yeasts and hydrogen-oxidising bacteria. Their wide range of yeast strains enables the production of oils with customised fatty acid profiles from a variety of organic byproducts with applications as cosmetic ingredient and surfactants. Their knallgas bacteria, using H2 as their chemical energy source, convert renewable carbon from emissions containing biogenic carbon dioxide into biomass, which can be used as bioplastics. Their power-to-liquid technology is designed to outperform carbon captured from point sources conversion processes using plants, algae and microbial strains such as archaea and acetobacter.

- CleanO2 Carbon Capture Technologies, a Canadian company that develops CarbinX™ capturing carbon dioxide emissions from building heating systems and transforms them into non-toxic pearl ash (potassium carbonate) to make soap bars. The machines use a heating system for urban buildings that use natural gas and, through a patented system, reduce the carbon impact. A single machine recycles as much carbon dioxide as 300 planted trees (6 to 8 tonnes of CO2).

- Beiersdorf , a German group with Nivea Men brand is the first manufacturer of skin care products to use an ingredient derived from recycled CO2, such as cosmetic ethanol which is used in numerous cosmetic products as moisturizers.

Sources :

Websites posts:

- Roberts, R. (2022, June 22nd). 2022 Beauty Industry Trends & Cosmetics Marketing: Statistics and Strategies for Your Ecommerce Growth. Common Thread collective website. https://commonthreadco.com/blogs/coachs-corner/beauty-industry-cosmetics-marketing-ecommerce

- Schmidt, S. (2023, February 17th). 5 Top Cosmetics Industry Trends to Watch in 2023 and Beyond. Website of Market research. https://blog.marketresearch.com/5-top-cosmetics-industry-trends-to-watch

- (2021, May 25th). 14 Trends Changing The Face Of The Beauty Industry In 2021. Website of CB INSIGTHS. https://www.cbinsights.com/research/report/beauty-trends-2021/

- Trends in the Cosmetics Industry US and Europe. Website of Snipp. https://www.snipp.com/cosmetics-industry-trends

Review articles:

- Ustymenko, R. (2023). TRENDS AND INNOVATIONS IN COSMETIC MARKETING. Economics & Education, 8(3), 12-17. https://doi.org/10.30525/2500-946X/2023-3-2

- Int. J. Pharm. Sci. Rev. Res., 68(1), May – June 2021; Article No. 30, Pages: 190-197. http://dx.doi.org/10.47583/ijpsrr.2021.v68i01.030